It's no secret that Americans are feeling financially vulnerable in the wake of the coronavirus pandemic.

And a survey shows how much their confidence has been hurt when it comes to one long-term goal: retirement.

Transamerica Center for Retirement Studies found that 23% of workers who are employed or recently unemployed said their confidence that they will be able to retire comfortably has gone down.

That insecurity was highest for baby boomers, born between 1946 and 1964, who are closest to retirement. Of those respondents, 32% said their confidence in their ability to retire has gone down due to Covid-19.

Meanwhile, 25% of members of Generation X, born between 1964 and 1978, said their retirement confidence has declined, while 20% of millennials, born between 1979 and 2000, said the same.

More from Personal Finance:

Pandemic is driving major changes to nursing home industry

Robocalls are spiking as fraudsters prey on Covid-19 fears

Pandemic shows how difficult it is to time the market

The research also identified how much each generation typically has put away in savings toward their later years. While millennials have a median (the middle in a list of numbers) of $23,000 saved in all household retirement accounts, Gen Xers had a median of $64,000, and boomers $144,000.

The study found those same workers also had socked away some money toward emergencies. Millennials had a median of $3,000 set aside, while Gen Xers had $5,000 and boomers had $15,000.

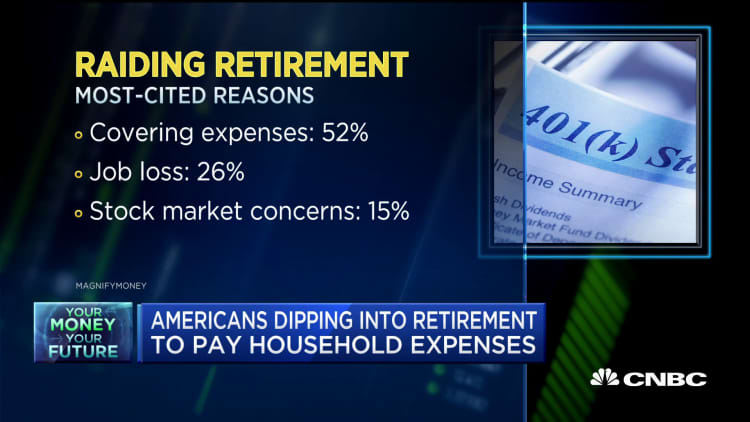

The recent downturn may lead them to dip into those savings, the survey found.

About 22% of workers said they have or plan to take a loan or withdrawal from a 401(k) or other workplace retirement savings account. Millennials were most likely to take such withdrawals, at 33%, compared to 15% of Gen Xers and 10% of baby boomers.

Transamerica recommended steps that workers can take to shore up their retirement confidence. Among them is to avoid seeking loans or withdrawals from retirement accounts, which can limit long-term growth.

Also keep saving toward retirement, if you can. That includes employer-sponsored plans, where there may be a match, or an IRA or both.

"By starting as early as possible and consistently saving over time, even small amounts can add up over a decades-long working life," the report states.

The online survey was conducted in two parts between November and December and again in April. The first part included 5,277 workers and the second survey included 1,248 respondents.